The Hong Kong Government announced in February 2022 the launch of the first retail Government green bonds. Such bond issuance is part of the Government Green Bond Programme (“Programme”).[1]

This article introduces the framework and bonds under the Programme.

Framework of the Programme

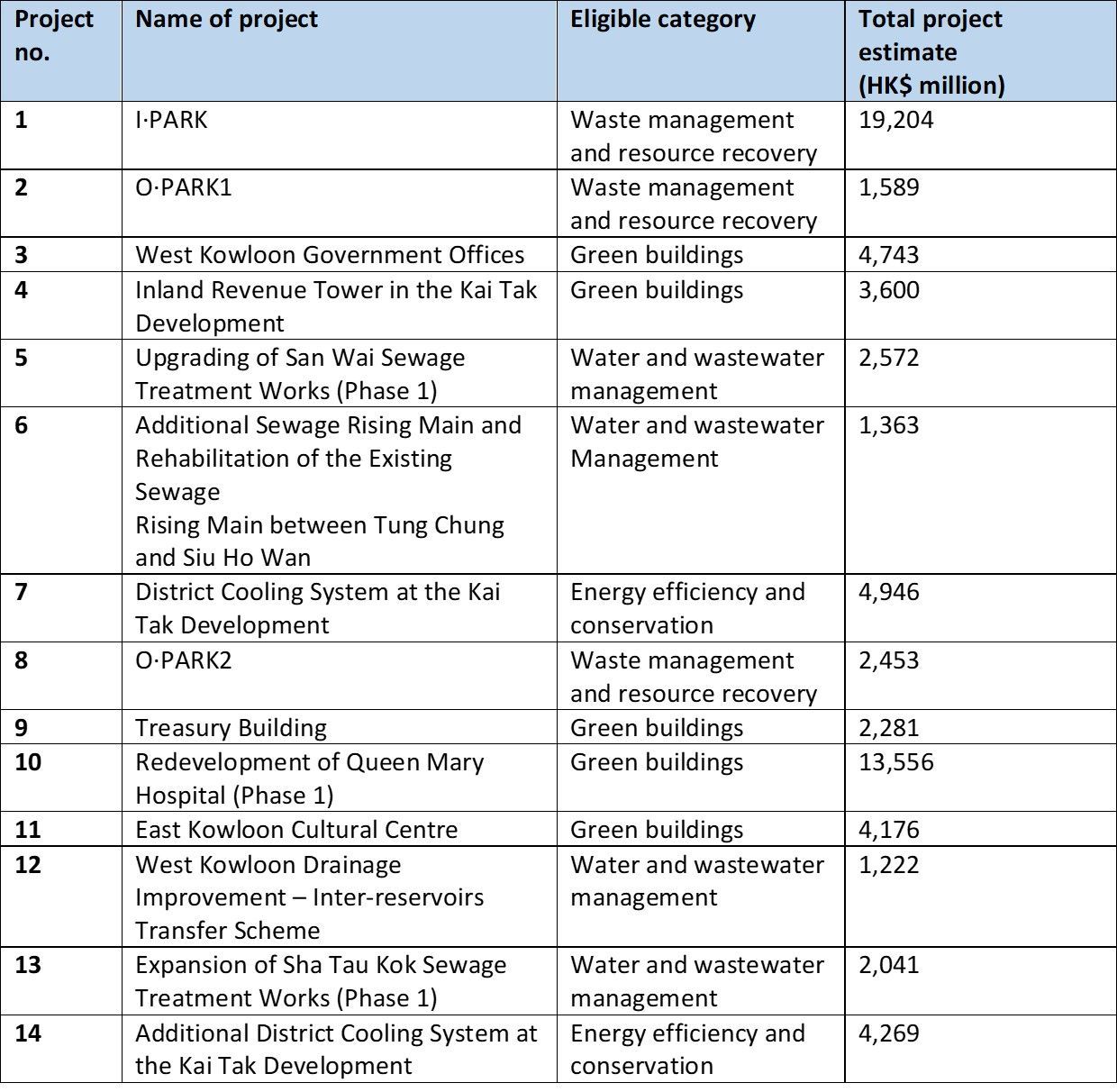

In February 2018, the Financial Secretary of the Hong Kong Government announced in his 2018-19 Budget to launch the Programme, with a borrowing ceiling of HK$100 billion (approximately US$12.8 billion)[2] , to demonstrate the commitment to promoting green finance and developing Hong Kong into a more sustainable and livable city.