Background

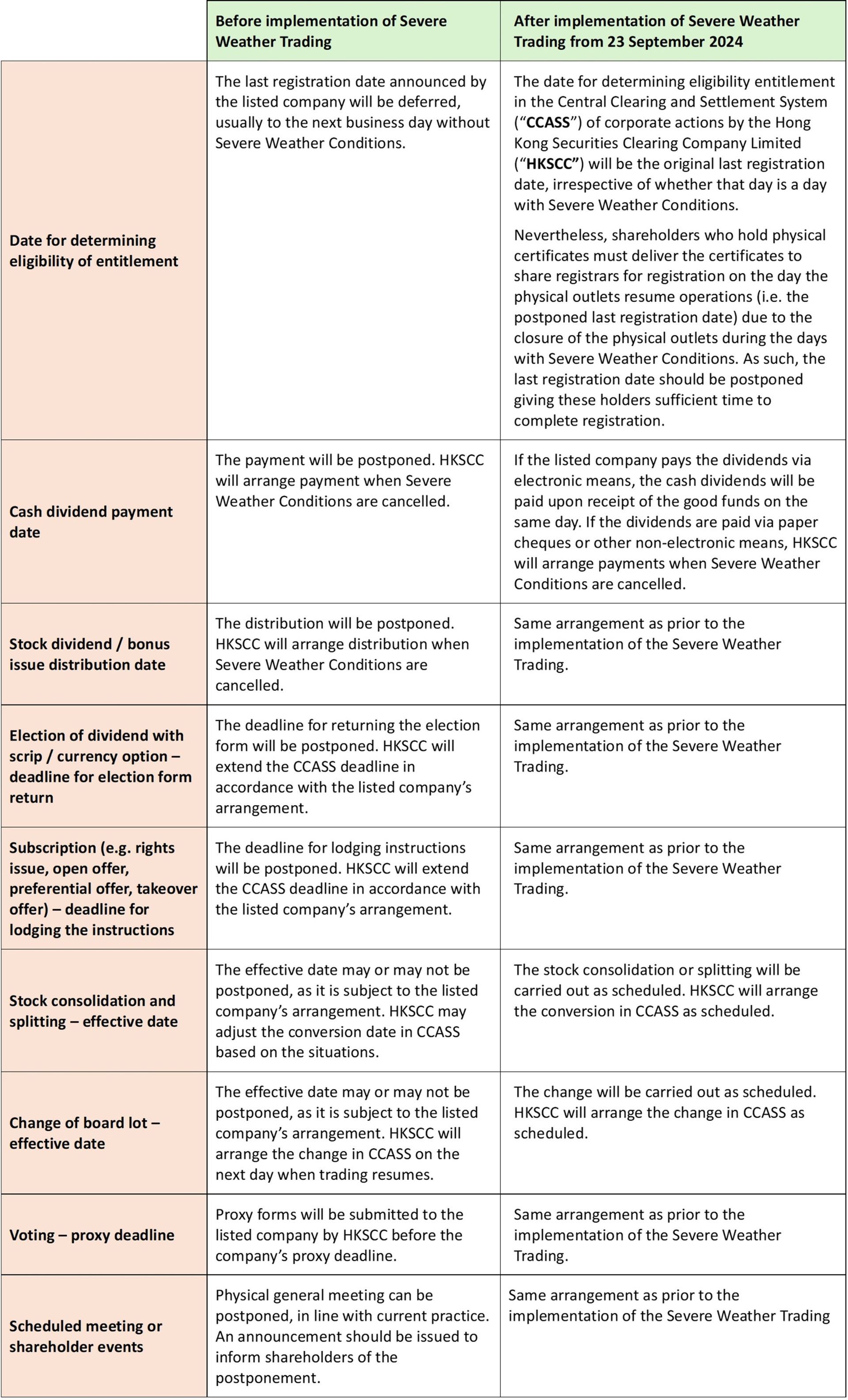

Hong Kong Exchanges and Clearing Limited announced that, from 23 September 2024 onwards, the Hong Kong's securities and derivatives markets will remain open and maintain normal operations in a digital and remote manner during severe weather conditions.

Due to its geographical location, Hong Kong is affected by typhoons and rainstorms almost every year, especially in summer. During the more serious instances, most government services are suspended, and schools, offices and businesses are closed. Currently, when “Typhoon Signal No. 8” or above is hoisted or after a “Black Rainstorm Warning” or an “Extreme Conditions” announcement is made by the Hong Kong government (“Severe Weather Conditions”), the securities and derivatives markets are halted.

Over time, the Hong Kong financial markets have developed digital and online facilities which proved to be robust during the COVID closure times. The city has the condition to keep the securities and derivatives markets open for trading during Severe Weather Conditions (“Severe Weather Trading”).